Make a one-Time Fee Shell out Cell phone Costs On line

Then you definitely get rid of your opportunity to earn best perks for the organization sales. The fresh SimplyCash In addition to Company credit card out of Western Show is excellent to own generating revenue right back to the mobile phone orders. That it card and brings dos% cash back on the groceries otherwise fuel, and you can step 1% money back every where else. That makes it a substantial find to possess investing your own cellular phone expenses and you will getting advantages on the everyday using.

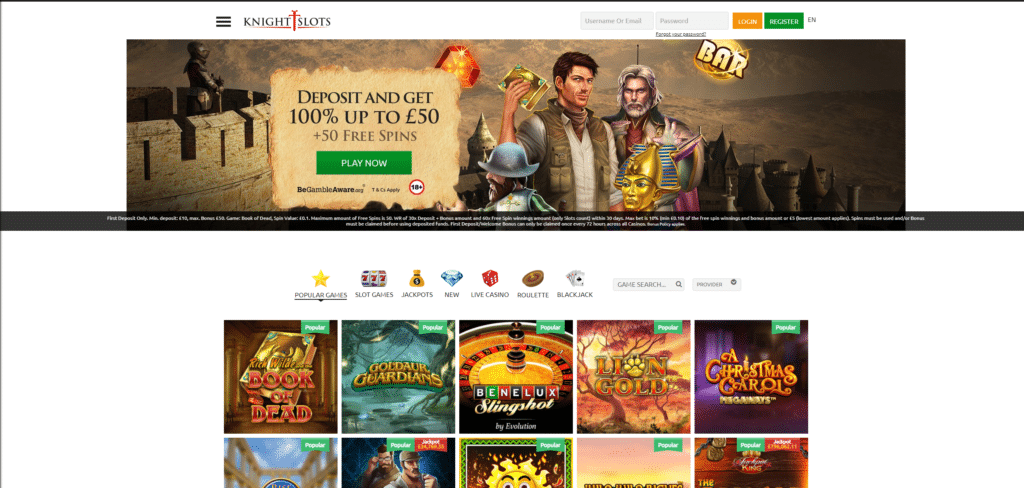

If you opt to found court sees and you can comments electronically and you may next need a paper observe, call us at the count on the rear of your credit and we’ll send they for you. Make use of your recognized lease total buy one or higher points within your lease restrict. I really hope this short article is actually useful, and this trained the principles of employing Pay by Cellular phone for local casino repayments, since it need.

How do Bank card Payments Performs?

We might mention or were ratings of the things, occasionally, although it does maybe not apply to all of our information, which are entirely in accordance with the research and you will functions your article group. We are really not contractually motivated at all to give self-confident or recommendatory analysis of their services. Keep in mind to compare the card possibilities very carefully to get the one that offers the greatest combination of cellular telephone perks and you may all-as much as benefits. Doing all of your fees might possibly be a frustration when you have to sift through your own credit card statements and figure out and this costs try business-related and you may that are personal. The 5% cash return bonus applies to the first $twenty-five,100 spent a year. You can earn 3X things for each and every buck to your as much as $2,one hundred thousand inside the spending per one-fourth.

View the Pursue People Reinvestment Operate Public Declare the lending company’s newest CRA score or any other CRA-related guidance. Furthermore, not all the merchants supply the accessibility to paying along with your electronic wallet. Merchants must have the right resources to accept cellular repayments. For this reason, it is best to create some cash or notes within the instance your find that it.

Your existing balance is https://mrbetlogin.com/energoonz/ actually people outstanding balance, and to possess requests because your past report. Their declaration balance is just one on your own latest statement. There are even procedures that allow make use of a charge card to own requests without having to pay one attention after all.

The administrative centre One Venture X Rewards Bank card is the most the best premium travel cards in the industry, club nothing, and also have one of the better cards for spending your mobile phone costs. You can rather enhance the redemption price by turning your money to Ultimate Advantages issues because of the pairing it card with a cards for instance the Pursue Sapphire Reserve (discover prices and fees). Earn dos% cash return for the earliest $25,000 invested inside mutual requests in the gasoline stations and you can eating per account anniversary year (up coming 1%) and you can step 1% to the all other purchases. As of 2024, the typical expenses to own a portable bundle stands in the $144 per month otherwise $step one,728 annually, according to CNBC. TPG thinking Ultimate Benefits issues in the a hefty dos.05 cents apiece, meaning in the step 3 things for every dollars, you can get on the $106 inside worth annually by using your own cellular telephone costs having so it cards. See that past round part — this is when your smartphone provider is available in.

It’s a method to easily availableness multiple payment actions and pick the most likely you to definitely to your problem. Making use of your debit card to have autopay setting your’d have to pay independently for mobile phone insurance policies. But once again, from the example more than, the fresh autopay discount exceeds the newest gained rewards because of the so much one you could still wind up preserving despite investing in insurance coverage. Playing cards constantly allow you to set up automated payments, and you’ll involve some options. You could choose to pay the minimal number, a set count for individuals who’lso are carrying a balance (such as $100 30 days), or even pay in full.

If you’ve has just altered their deadline, you’ll want to hold back until after the the newest due date in order to establish autopay. The following sort of profile can only create alerts playing with on line financial. Notice, they also have to have the exact same aware attractions if you’ve went paperless. We’ll require some of your personal guidance discover the application form and look to possess reputation. Score notified if the percentage is due, their readily available borrowing strikes a particular endurance and much more. Look at their declaration, pay your costs, manage your account choice and more.

Having automated money, you’ll ask your mastercard issuer to help you immediately bring funds from your finances to spend your charge card. The brand new issuer can be withdraw the minimum fee, the whole balance otherwise an excellent prespecified number for the a prespecified date. Just be sure you’ve got enough money into your savings account before the automated payment experiences. Credit composed of (i) Apple quick exchange-within the credit from the checkout and (ii) T-Cellular monthly bill loans applied over 2 yrs. Ensure it is dos expenses schedules from legitimate submitting and you will validation out of trading-in the. Being qualified credit, study package, and you will change-within the (age.grams., iphone 15 Pro Max) inside the good condition required.

Which have cellphones essentially a requirement for everyday routine, chances are high you’lso are investing a month-to-month cell phone costs. MyBankTracker have partnered having CardRatings in regards to our exposure out of mastercard points. MyBankTracker and you can CardRatings could possibly get discovered a fee out of card issuers. Feedback, analysis, analyses & suggestions will be the author’s alone, and also have not started assessed, recommended or passed by some of these organizations.

How do i secure or discover my personal credit card?

It’s vital that you pay no less than your own minimal fee on time per month. On-time repayments are you to important aspect of making and you will keeping a great positive credit rating. Forgotten repayments is also tarnish your credit score that will affect their creditworthiness. Investing the credit card may appear for example a small activity, but it is going to be a critical one to.

Much like Fruit Pay, you can add a lot more to that purse than just credit otherwise debit cards. Apple Spend are a great contactless means for apple’s ios users and then make repayments. They spends biometric examination technology entitled Deal with ID or Touch ID, you can also play with an excellent passcode to get into the brand new handbag. You can add any debit or bank card as well as Fruit Cash, boarding seats, knowledge tickets, provide cards and a lot more to your bag. Fruit Spend try commonly recognized at the retailers and you may eating in the world. Of course, the new rewards made on your month-to-month smartphone commonly probably going to be adequate to completely offset the cost of an annual percentage for the a cards.